The North American automotive aftermarket industry may be facing the most daunting range of ongoing supply chain and distribution challenges to date, emanating from the COVID-19 pandemic crisis. In normal times, the aftermarket comprises one of the most complex and dynamic supply chains of any global industry. The addition of pandemic problems adds severe pressure on a system whose essence is just-in-time (JIT) delivery to wholesale and retail customers alike.

The currently tangled supply chain urgently demands effective innovative logistics strategies. The good news is that these strategies and tools will make the aftermarket industry more resilient so they can function more efficiently once the dust clears, and be able to weather slowdowns in the future.

Aftermarket: Never a simple proposition

According to Grand View Research, the global aftermarket size was valued at $390.10 billion in 2020. The industry has historically been recession resistant, but supply chain disruptions make a strategic impact across the industry.

In normal times, aftermarket producers and distributors face intense competitive challenges:

In normal times, aftermarket producers and distributors face intense competitive challenges:

- Millions of SKUs originating from nearly every manufacturing center around the globe

- Complex products requiring precise manufacture and careful handling

- Lengthy feedstock supply chains

- Narrow production base for most SKUs

- Far-flung retail/wholesale distribution network

- Dependency on JIT production and distribution strategies

- Intense domestic sales competition in every product segment

- Competing global procurement demand in every product segment

- Complete responsibility for end-user satisfaction

- High percentage of damaged-as-delivered items

Since the start of 2020, the industry has also been confronted by a tag-team of unforeseen events that have had substantial impact on the aftermarket supply chain:

- Extended, extreme shortage of new automobiles, leading to the expanded demand for parts to keep older vehicles running longer

- Severe dysfunction beginning in the Asia-originated supply chain, and rippling throughout the world

- Domestic inflation and international currency fluctuation

A tangled chain

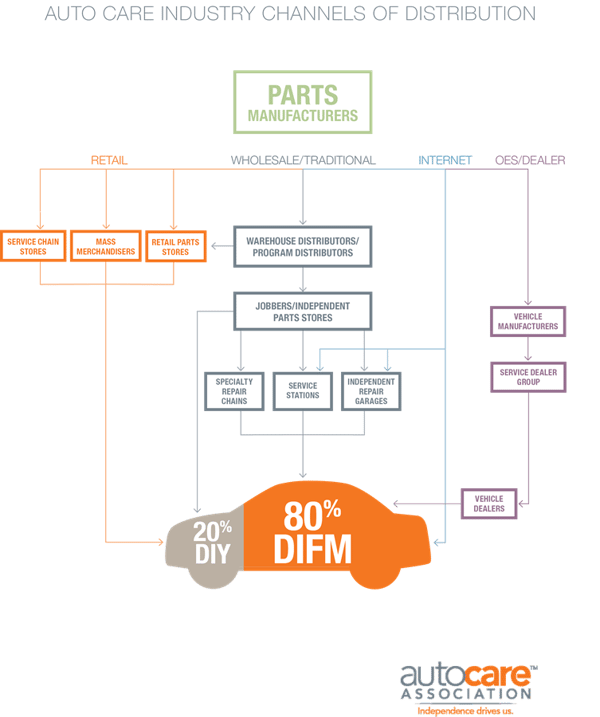

Logistics is the single most vital corporate function for practically every participant in the aftermarket industry, whether they are a parts distributor or producer, or any of the many layers in-between. Aftermarket distributors must rationalize global sourcing, arrange careful shipping, and deliver to a wide variety of customers. For the import-oriented distribution side, every non-distribution function is secondary to getting things where they need to be. Domestic component producers must carefully balance feedstock supply and precision delivery to keep OEM assembly plants running with minimal inventory exposure.

“This is the most difficult supply-chain environment that I have ever seen,” AutoZone Inc. Chief Executive Officer William Rhodes said in a September 2021 earnings call. AutoZone is running “the lowest level of in-stock that I can ever remember,” said Rhodes, who joined the company in the 1990s and has been CEO since 2005.

Weak links all along the chain

The origin of the problem was the knee-jerk reaction to the unprecedented COVID-19 crisis. Most companies directed non-essential employees to work from home. Educational institutions converted to at-home learning. Stores, malls, cinemas, restaurants, etc. either adapted to some form of curbside service, or shut down altogether.

Total miles driven nationwide in 2020 declined by more than 13% below 2019, enough to dramatically change the outlook for new automobile production and service requirements for older vehicles. Upstream, parts producers and distributors scaled back inventory requirements, and shippers reduced capacity. Essentially, a system calibrated for continuous, high-performance operation was hastily throttled back.

The result has been a pile-up of problems throughout the length of the aftermarket supply chain. Container transit from Shanghai to Chicago is historically a 35-day journey; at its worst, in June, a container took 73 days to complete the trip.

So where are your parts? Pick the one that applies: Waiting for a container in Asia; waiting on a ship moored off the California coast; waiting on the dock for a chassis; waiting in a warehouse lot; waiting for a live body since thousands of dockworkers, truck drivers, warehouse workers and clerks aren’t working due to COVID concerns, low pay, and what many people are calling the “The Great Resignation.”

Customer chain is also slowed down

The aftermarket supply chain woes are bearing down hardest on U.S. auto garages.

The auto repair delays seem particularly acute in the U.S. because spare parts produced in Asia get tangled in the global shipping clog and cargo jams at seaports.

On the retail repair shop level, the challenge of finding spare parts as mundane as oil filters is driving garage managers to hoard inventory, innovate workarounds, and in the worst cases, to plead with customers for patience until a part comes in. In an industry that pioneered just-in-time delivery, delays of a day or two were considered long. Now, “Stuff that was normally next-day, second-day (delivery) is now three to four days, ten days, two weeks,” says a Massachusetts repair shop manager. A Dodge Ram pickup truck was towed in to a Seattle-area garage needing a crankshaft position sensor. Normally it would be a regular stock item at any of several local wholesale sources. But as the wait extended to two months, the truck’s frustrated owner planned to tow it and buy a new truck. But the OEM semiconductor shortage meant that he’d have to wait at least as long for a new truck.

A Dodge Ram pickup truck was towed in to a Seattle-area garage needing a crankshaft position sensor. Normally it would be a regular stock item at any of several local wholesale sources. But as the wait extended to two months, the truck’s frustrated owner planned to tow it and buy a new truck. But the OEM semiconductor shortage meant that he’d have to wait at least as long for a new truck.

“No garage is being spared, whether franchise dealers who get their parts from the major automakers, independent warehouses, or small corner garages,” McCarthy said, adding that shortages will probably continue into next year.

The last mile is just as tough as the first. Delivery drivers are the last link in the aftermarket supply chain, and there aren’t enough of them, either.

“Deliveries are getting very complicated. The companies we are dealing with, they have problems with drivers and all that,” reports a Miami-area shop owner.

Getting around the traffic

Forward-thinking aftermarket logistics specialists can take measures to minimize the delay impact on their shipments, on both the receiving and distribution sides.

A key strategy is to be flexible, and develop new or secondary routing options. Your freight forwarder or carrier can develop alternative routing through other, nearby ports. There’s usually only a small cost difference in origin charges, and once the alternative route is validated, you have an expanded pipeline, that can avoid congestion episodes affecting a particular facility.

Flexibility is also helpful for the domestic leg, to work around the shortage of drivers and chassis. If your customary warehouses are backed up, consider other unloading or transloading facilities. Other modes such as rail can be utilized to your benefit.

Supply chain congestion isn’t just preventing imported replacement parts from getting to distributors’ shelves. Shortages and congestion also affect domestic production. Spikes in the price of steel, rubber, and other basic production materials, along with workforce shortages and transportation issues slow down domestic production too, relates Paul McCarthy, chief executive of the Automotive Aftermarket Suppliers Association (AASA).

More than ever, reliable, robust, innovative, simplified supply chain solutions are imperative to companies operating in the automotive aftermarket. Your best bet for broadening your supply chain — and your OTD to customers — is a nimble 3PL partner.